The 20-Second Trick For Real Estate Reno Nv

The 20-Second Trick For Real Estate Reno Nv

Blog Article

The 8-Second Trick For Real Estate Reno Nv

Table of ContentsReal Estate Reno Nv Things To Know Before You BuyThe Main Principles Of Real Estate Reno Nv Real Estate Reno Nv for BeginnersA Biased View of Real Estate Reno NvLittle Known Questions About Real Estate Reno Nv.Real Estate Reno Nv for Beginners

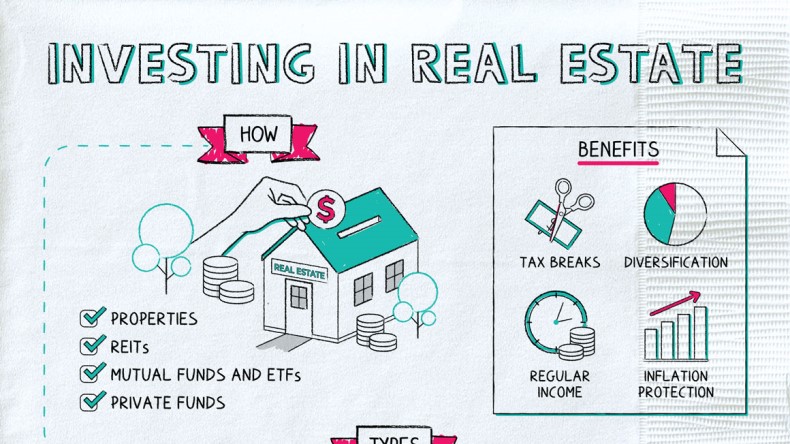

The benefits of investing in property are many (Real Estate Reno NV). With well-chosen possessions, investors can appreciate predictable money circulation, excellent returns, tax advantages, and diversificationand it's feasible to utilize genuine estate to develop wealth. Considering buying realty? Right here's what you require to find out about actual estate benefits and why realty is thought about a great investment.

The advantages of spending in actual estate include passive income, steady money circulation, tax advantages, diversity, and take advantage of. Real estate financial investment trust funds (REITs) offer a way to spend in actual estate without having to own, operate, or financing properties.

Genuine estate values often tend to increase over time, and with a great investment, you can transform a revenue when it's time to market. As you pay down a building mortgage, you construct equityan possession that's part of your net well worth. And as you develop equity, you have the utilize to purchase even more residential properties and raise cash money flow and riches also much more.

Property has a lowand in some cases negativecorrelation with various other major possession courses. This means the enhancement of property to a profile of diversified possessions can lower portfolio volatility and give a higher return each of risk. Take advantage of is the usage of various monetary tools or obtained resources (e.

Not known Incorrect Statements About Real Estate Reno Nv

As economic situations expand, the demand for real estate drives leas greater. This, subsequently, translates into higher resources worths. Genuine estate has a tendency to keep the acquiring power of resources by passing some of the inflationary stress on to tenants and by integrating some of the inflationary pressure in the form of capital appreciation.

There are numerous means that having realty can safeguard against inflation. Initially, property values may climb greater than the price of rising cost of living, causing resources gains. Second, rents on financial investment buildings can increase to keep up with rising cost of living. Residential properties financed with a fixed-rate finance will certainly see the relative amount of the month-to-month mortgage payments drop over time-- for instance $1,000 a month as a fixed settlement will certainly end up being much less burdensome as inflation deteriorates the buying power of that $1,000.

One can profit from selling their home at a price higher than they paid for it. And, if this does take place, you might be liable to pay tax obligations on those gains. Regardless of all the benefits of purchasing realty, there are disadvantages. Among the main ones is the lack of liquidity (or the family member problem in transforming an asset into money and money into a property).

Real Estate Reno Nv Things To Know Before You Get This

Why spend in genuine estate? The truth is, there are several genuine estate benefits that make it such a popular selection for knowledgeable investors.

However the remainder goes to paying for the loan and structure equity. Equity is the worth you have in a residential or commercial property. It's the difference between what you owe and what the house or land is worth. With time, normal payments will eventually leave you having a residential or commercial property free and clear.

Our Real Estate Reno Nv Diaries

Anyone that's gone shopping or loaded their tank just recently recognizes exactly how inflation can damage the power of hard-earned cash. One of the most underrated realty benefits is that, unlike many standard financial investments, property value has a tendency to increase, also throughout times of noteworthy rising cost of living. Like various other vital properties, real estate frequently maintains worth and can as a result operate as an excellent location to invest while higher prices gnaw the gains of numerous other investments you might have.

Admiration describes cash made when the overall value of a property climbs in between the time you buy it and the time you sell it. For real estate, this can imply considerable gains because of the typically high prices of the assets. It's critical to keep in mind recognition is a single point and only provides money when you sell, not along the means.

As mentioned previously, cash money circulation is the money that begins a month-to-month or yearly basis as a result of possessing the building. Usually, this is what's left over after paying all the necessary expenses like home mortgage payments, fixings, tax obligations, and insurance. Some residential or commercial properties might have a considerable cash money circulation, while others might Read Full Article have little or none.

Real Estate Reno Nv - The Facts

Brand-new investors may not genuinely recognize the power of take advantage of, but those that do open the possibility for massive gains on their financial investments. Normally talking, utilize in investing comes when you find here can own or manage a bigger quantity of assets than you could or else spend for, through using credit scores.

Report this page